Governance Structure and Operations

- Operations of the Board of Directors

- Policy and Procedures for Appointing Director Candidates, and Applicable Approaches and Standards, etc.

- Executive System and Appointment of Executive Officers

- Compensation for Directors and Executive Officers

- Group Auditing System

Operations of the Board of Directors

Operation

In principle, the Board of Directors meets once a month. Prior to the meeting, the Chairperson of the Board and the President confirm the agenda items to be discussed and align their understanding of the agenda for the next three months to optimize the cycle of exercising supervision over business execution. In addition to distributing materials in advance, the secretariat or the executive officer and corporate vice president in charge explain important agenda items to outside directors individually beforehand. The Board of Directors takes questions and feedback from outside directors in advance, allowing it to focus on critical issues and hold high-quality discussions.

In executive sessions, information is exchanged and understanding is shared from an objective standpoint, creating a virtuous cycle that enhances the effectiveness of the Board of Directors. Additionally, we have set a time for informal and open discussions using a directors’ roundtable meeting format, creating an environment where execution and supervision can candidly discuss issues interactively.

Attendance

The meeting results and attendance rates for the Board of Directors and the three committees at the end of fiscal 2024 are shown in the table below.

Furthermore, the attendance rate at meetings of the Board of Directors and the three committees for the five outside directors (Chikatomo K.Hodo, Soichiro Sakuma, Akira Ichikawa, Masumi Minegishi and Takuko Sawada) was 100%.

Note:All members of the Board of Directors are required to attend more than 80% of the meetings. To achieve this attendance rate, the number of companies they can serve as directors (officers under Japan’s Companies Act) is restricted to no more than three listed companies, in principle.

| Board of Directors | Nominating Committee | Audit Committee | Compensation Committee | |

|---|---|---|---|---|

| Number of meetings | 14 | 6 | 13 | 7 |

| Attendance rates for all directors (%) | 100 | 100 | 100 | 100 |

| Attendance rates for outside directors (%) | 100 | 100 | 100 | 100 |

Activities of the Board of Directors and the Three Committees in Fiscal 2024

- Board of Directors

Fiscal 2024, the second year of the Medium-term Management Plan, was positioned as a year to drive structural reforms by resolutely carrying out business selection and concentration, in order to lay the foundation for growth from fiscal 2025 onward. In this context, the Board of Directors established key monitoring areas and provided oversight and advice.

The Board of Directors focused its discussions on several key matters, including the execution of global structural reforms, items related to business divestitures to accelerate business selection and concentration, and medium- to long-term growth strategies based on our core technologies. Prior to Board deliberations, informal Board discussions were held to clarify the priorities of the Board at an early stage of the executive decision-making process, thereby creating an environment where the Board could concentrate discussions on important issues. In conjunction with this, in setting the Board's agenda, efforts were made for efficient operation, such as implementing written resolutions and reports in a timely manner, and for agenda items aimed at information sharing, materials were distributed in advance so that only questions and answers were conducted on the day of the Board meeting. - Nominating Committee

In light of the review by Corporate Governance Committee of the composition of the Board of Directors and committees and the criteria for their appointment, we carefully discussed, exchanged ideas, and verified the responses.

(1) Review of the composition of Board of Directors by the Corporate Governance Committee

<Review Approach>

• The Board of Directors shall have an appropriate number and composition to achieve sustainable growth and increase corporate value, taking into account the Company’s medium- and long-term business issues and strategies.

<Review Results>

• The total number of directors shall be nine, consisting of five independent outside directors and four internal directors.

• The selection of new outside director candidates will proceed after clarifying the desired qualifications and their priorities.

• The Chairperson of the Board shall be selected from among the independent outside directors.

• One of the internal directors shall be a director who does not concurrently serve as an executive officer and shall be a full-time audit committee member.

• Internal directors who concurrently serve as executive officers shall be selected taking into account the roles to be played on the Board of Directors based on management strategies and other factors.

(2) Based on the above, the Nominating Committee discussed and confirmed the following:

<Independent Outside Directors>

• As two of the current five independent outside directors will retire due to the tenure limits stipulated in the Nomination Committee regulations, the same number of new independent outside director candidates have been selected in accordance with the above-mentioned requirements and priorities. The remaining three will continue to serve as candidates for independent outside directors.

While continuing the discussions that have been held from a medium- to long-term perspective, the aim is to further invigorate the Board of Directors by incorporating new opinions and perspectives.

<Candidates for Director>

• All nine Directors whose terms of office will expire shall continue to be candidates for Director. The Company considers it appropriate for the Board of Directors to continue discussions from a medium- to long-term perspective

<Chairperson of the Board>

• As one of the two independent outside directors retiring due to the tenure standards is the Chairperson of the Board of Directors, a new candidate for Chairperson of the Board of Directors has been selected in accordance with the selection process stipulated in the appendix to our company's Basic Policy on Corporate Governance. This is because the candidate meets the requirements stipulated in said process and is suitable for the role of leading discussions on the medium- to long-term growth strategy at the Board of Directors, based on technical knowledge in our company's business selection and focus, in addition to an experienced management perspective.

<Directors who do not concurrently serve as Executive Officers>

• Current Directors who do not concurrently serve as Executive Officers shall continue to be candidates as they have extensive experience with internal audits and are expected to increase the effectiveness of the Audit Committee as full-time members.

<Internal Directors who concurrently serve as Executive Officers>

• Current Directors who concurrently serve as Executive Officers shall continue to be candidates. In addition to the President, the committee will include the Executive Officer in charge of accounting and finance and the Executive Officer in charge of the Industry Business to ensure accountability in important management decisions and contribute to effective discussions.

Note that when appointing Executive Officers, the Nominating Committee received reports on the selection process and reasons for selection, and reviewed them prior to the Board of Directors’ resolution. Since the change of President in April 2022, we have consistently worked on the succession plan for the next President. We will continue to receive regular reports from the President on the Progress of the succession plan and provide supervision and advice. - Audit Committee

The Audit Committee audited the legality and propriety of management decision made by directors, executive officers and corporate vice presidents confirmed the facts of improper conduct as well as violations of the law or articles of incorporation, and monitored and verified the internal control system that has been established and put into operation. It also rigorously reviewed whether an independent position was maintained in the external accounting auditor’s audit and whether a proper audit was conducted and determined selections or dismissals of Accounting Auditors. - Compensation Committee

In fiscal 2024, in order to appropriately evaluate the achievement status of strategic priority measures as an incentive in the individual evaluation for annual performance-based cash bonus, the Compensation Committee received explanations from the President & CEO regarding the key issues and progress of each executive officer's strategic priority measures at the beginning of the fiscal year (May) and midway through (November), and provided oversight and advice.

Based on this, after the end of the fiscal year, at the Compensation Committee meeting held in May, the President & CEO proposed the target achievement status and evaluation plan (evaluated on a scale of 0% to 200%, with 100% as the standard) for each executive officer's strategic priority measures. As a result of deliberation, the amount of annual performance-linked monetary compensation for each executive officer was determined, together with the performance level and performance target attainment components.

Furthermore, the committee discussed the ideal state of the executive compensation system that could serve as an incentive for achieving the goals of the next medium-term management plan, identifying it as a topic for future consideration.

At the Compensation Committee meeting held on April 28, 2025, envisioning the management direction and strategy from fiscal 2026 onward, a resolution was passed to introduce TSR as an evaluation indicator for stock-based compensation. Concurrently, with the introduction of TSR, it was confirmed that the evaluation period for TSR would commence from fiscal 2025 in order to further strengthen the motivation of officers to improve stock prices starting from that fiscal year.

Provision of Information and Support System for Outside Directors

- Provision of Information to Outside Directors

The actions described in Training of Directors below are taken.

Also, each outside director is provided with information including the market trend, IR, and crisis management. - Supporting System for Outside Directors

The Audit Committee Office serves as the secretariat for the Audit Committee, while the Board of Directors Office serves as the secretariat for the Board of Directors, the Nominating Committee, and the Compensation Committee. Staff members of each office support the outside directors to ensure the proper functioning of the Board of Directors and its committees.

The secretariat distributes materials to outside directors in advance and provides a briefing on the agenda up to three months ahead of meetings. Additionally, the secretariat, along with the executive officers or corporate vice presidents responsible for the agenda, explains key agenda items in advance. This setup creates an environment where the Board of Directors can focus on critical issues and operate efficiently and seamlessly. The secretariat also plans, proposes, and accompanies Board members on visits to worksites as part of its information-provision duties.

Training of Directors

In accordance with the director election standards, the Nominating Committee selects candidates who possess the qualities needed to be a director. The Company assesses whether new directors require training based on their individual’s knowledge, experience, and other characteristics. If training is deemed necessary, the Company provides suitable opportunities for it.

- For new independent outside directors, the Company provides information about the group’s structure, business activities, finances, the medium-term business plan, its progress, and other relevant subjects. Additionally, the Company offers basic information about its businesses and corporate-level functions, as well as analyst reactions to financial results briefings.

- For independent outside directors, the Company arranges visits to the development, manufacturing, sales, service, and other operations of each business unit. Executive officers, corporate vice presidents, and frontline employees provide the latest information about each business during these visits.

Activities in fiscal 2024 are listed below:

• Two outside directors participated in person at an internal technology presentation (Value Creation Forum) jointly held by the four business domains, received direct explanations from employees at each booth, and engaged in Q&A and opinion exchanges.

• Two outside directors participated online in an internal presentation meeting (Process Improvement Executive Briefing).

• Three outside directors visited Konica Minolta's Sakai Site and Osaka Sayama Site.

• Two outside directors visited Konica Minolta Supplies and Konica Minolta's Kofu Site.

• Three outside directors visited Konica Minolta Mechatronics.

• Four outside directors visited Konica Minolta Japan. - New inside directors are provided opportunities to attend governance training held by external institutions, and information about various seminars is given to inside and outside directors as opportunities to participate when appropriate.

Evaluation of Board of Directors Effectiveness

In 2003, the Company transitioned to a company with committees (now a company with three committees). To assess whether the corporate governance system is functioning as intended, the Company began performing self-assessments of the Board of Directors’ effectiveness in 2004. These self-assessments have been conducted annually since then to facilitate ongoing improvements.

Each year, past activities are reviewed, and self-assessments of the Board of Directors’ and the three committees are carried out to ensure that the corporate governance system contributes to sustainable growth and improvements in medium- and long-term corporate value. Based on these assessments, issues that the Board of Directors needs to address in the upcoming fiscal year are identified, and measures to enhance effectiveness are planned.

In fiscal 2022, an evaluation of the effectiveness of the Board of Directors was conducted by an external organization, based on the fact that it was a major turning point in the Company’s corporate governance. In fiscal 2023, the Board of Directors took the lead in conducting the evaluation itself, taking into account newly recognized issues. In fiscal 2024, while confirming the responses to and the progress of improvements on the issues identified in the previous evaluation, the results will be reflected in the Board Chair’s policy on the operation of the Board of Directors for fiscal 2025 and in the agendas of each committee, thereby linking the findings to specific improvement actions.In fiscal 2022, an evaluation of the Board of Directors' effectiveness was conducted by an external organization as it was a major turning point in our company's corporate governance. In fiscal 2023, the Board of Directors proactively conducted its own effectiveness evaluation, taking into account newly identified issues. In fiscal 2024, while confirming the response to and improvement status of issues identified from the previous evaluation, the evaluation results will be reflected in the Board Chairperson's operational policy for the Board of Directors for fiscal 2025 and in the agendas of each committee, leading to improvement actions.

For details on the effectiveness assessment of the Board of Directors, see pages 16 through 19 of the Corporate Governance Report.

Policy and Procedures for Appointing Director Candidates, and the Applicable Approaches and Standards, etc.

Policy and Procedures for Appointing Director Candidates

Based on reviews concerning the composition, standards for selection, etc. of the Board of Directors and committees by the Corporate Governance Committee, the Nominating Committee raises its policy to upgrade its selections of Director candidates by performing yearly examinations from the standpoints of balance of knowledge, experience and capabilities, and diversity, and uses the following process to make selections.

<Board of Directors>

1) Confirmation of Directors who will resign due to standards for the number of years as a Director or age and expected number of new Outside Director and new Inside Director candidates.

<Outside Director Candidates>

2) To select Outside Director candidates, after the Nominating Committee confirms the selection process, the members of this committee determine the knowledge, experience and capabilities that will be required of new Outside Directors in order to enable them to be a good match with Outside Directors to be reelected.

3) The Nominating Committee Chairperson asks for a broad range of recommendations for candidates, based on information from Nominating Committee members, other Outside Directors, and the President. To provide reference information, the Board of Directors Office distributes to Nominating Committee members etc. a candidate database, centered on “chairpersons” of global companies, that includes information about independence, age, concurrent positions and other characteristics of candidates.

4) The Nominating Committee takes into consideration the items listed below in order to narrow down the number of candidates, from the recommended individuals obtained through the preceding process in order to determine an order of priority.

• Selection standards for Directors

• Standard for independence of Outside Directors

• Balance of knowledge, experience and capabilities required for Outside Directors and diversity (skill matrix)

5) The Chairperson of the Nominating Committee and, if necessary, a member appointed by the Chairperson, will interview the candidates in order of candidacy, and approach them about assuming the position of Outside Director.

<Inside Director Candidates>

6) Candidates for “Internal Directors” shall be discussed between the President and the Internal Nominating Committee on the basis of the following points; proposed candidates for Directors who shall not concurrently serve as Executive Officers, and proposed candidates for Directors who shall concurrently serve as Executive Officers, once the President has shared with the Internal Nominating Committee his/her concept for the executive structure for the next fiscal year.

• Selection standards for Directors

• Roles of Directors who do and do not concurrently serve as Executive Officers

• Required skills, experience and other characteristics of Directors who do and do not concurrently serve as Executive Officers (skill matrix)

7) The Nominating Committee uses the draft proposals to examine the candidates.

The Applicable Approaches and Standards for Appointing Director Candidates

1.Board of Directors

(1) Approach to the Overall Board of Directors Composition

The Board of Directors is composed of a number of directors within the scope provided in the Articles of Incorporation, taking into account the management issues the Board of Directors is required to address.

1) To ensure management transparency and supervisory objectivity, the majority of the total number of directors shall be independent outside directors.

2) The Company considers five to six Outside Directors to be appropriate for ensuring both diversity of discussion and speed of decision-making.

3) To enhance the management supervision function, liaise with the independent outside directors and strengthen communication and cooperation with executive officers, more than one inside directors not concurrently serving as executive officers will be appointed.

4) To further enhance deliberations on important decisions from a management standpoint, in addition to the President, several executive officers in charge of principal duties will be appointed as directors.

5) The Nominating, Audit and Compensation committees are all chaired by outside directors to ensure transparency and objectivity. In addition, to ensure that each committee adequately fulfills its respective roles, each committee is composed of around five members, and a majority of its members is independent outside directors.

6) For more information about the diversity of the Board of Directors, see "Balance of career and skill required for outside director candidates and diversity."

(2) Selection Standards for Directors

The Nominating Committee has selected candidates who satisfy the following standards as being suitable directors for achieving good corporate governance, i.e., ensuring the transparency, soundness, and efficiency of the Company's operations.

1) Good physical and mental health

2) A person that is well liked, dignified, and ethical

3) Completely law-abiding

4) In addition to having objective decision-making abilities for management, the person must have good foresight and insight

5) Someone with no potential conflict of interest or outside business relations that may affect management decisions in the Company's main business areas, and who has either organizational management experience in the business, academic, or governmental sectors or specialized knowledge in technology, accounting, law, or other fields.

6) For outside directors, a candidate with a history of performance and insight in their field, someone with sufficient time to fulfill the duties of a director, and who has the ability to execute required duties as a member of the three relevant committees.

7) The Nominating Committee establishes criteria for the re-election of directors, including considerations regarding the number of terms of office, age, and other factors. The maximum term of office for an outside director is eight years, with a basic term six years. However, upon a resolution by the Nominating Committee, however, the term of office may be extended once for an additional period of two years. The Nominating Committee shall confirm this extension during the fourth year of the director’s term.

8) Potential director candidates must not be excluded on the basis of gender, nationality, country of origin, cultural background, race, ethnicity, or similar reason.

9) In addition, the candidate must have the abilities necessary for a director to run and build a public corporation that is transparent, sound, and efficient.

2.Outside Directors

(1) Criteria on the Independence of Outside Directors

The following types of people are ineligible to serve as outside directors at Konica Minolta. Our Nomination Committee selects outside director candidates with a high level of independence, provided that none of the following criteria apply.

1) Person affiliated with Konica Minolta

- Former employee of the Konica Minolta Group

- Having a family member (spouse, child, or any blood or marital relative twice removed or less) that has served as a director, executive officer, auditor or top manager in the Konica Minolta Group during the past five years.

2) Person affiliated with a major supplier/client

- Currently serving as a managing director, executive officer, or employee of a major supplier/client company/group that receives 2% or more of its consolidated sales from the Konica Minolta Group or vice versa.

3) Specialized service provider (lawyer, accountant, tax accountant, patent lawyer, judicial scrivener, or a consultant for management, finance, technology, or marketing)

- Specialized service provider that received annual compensation of ¥5 million or more from the Konica Minolta Group during the past two years.

4) Other

- A shareholder holding more than 10% of the voting rights in the company (executive directors, executives, or employees in the case of a corporate body)

- A director taking part in a director exchange

- A director, executive officer, auditor or equivalent position-holder of a company that competes with the Konica Minolta Group, or someone holding 3% or more of the shares of a competing company

- Having some other significant conflict of interest with the Konica Minolta Group

(2) Balance of Career and Skill Required for Outside Director Candidates and Diversity.

1) To ensure the diversity of directors, the Nominating Committee Rules for selection standards for directors state that candidates should "have experience operating an organization in the industrial, government or academic sector or have specialized skills involving technologies, accounting, law or other fields" and "have accomplishments and knowledge in their respective fields suitable for outside director candidates." Moreover, potential director candidates must not be excluded on the basis of gender, nationality, country of origin, cultural background, race, ethnicity, or similar reason.

2) Candidates should have the character, skill and experience needed for strengthening and upgrading management in order to enable the Board of Directors to determine the Company's strategic direction.

3) To ensure that the Board of Directors can provide useful oversight and advice regarding the Company's management issues, it must have members with diversity of knowledge, experience, and abilities, and this needs to be considered when reappointing eligible outside directors or selecting new candidates. Decisions should be made with a view to ensuring the Board's ideal skill matrix, including requirements for industries of origin, main management experience, and areas of specialty.

(3) Expected Roles of Outside Directors.

1) To participate in important decisions made by the Board of Directors and supervise the decision-making process

2) To submit advice about the establishment of management policies and plans and about reports concerning business operations by using their experience and knowledge

3) To oversee conflicts of interest among the Company, its shareholders, senior executives, and others

4) To supervise management to protect ordinary shareholders and to reflect the interests of shareholders from the standpoint of ordinary shareholders, which is independent from senior executives and special stakeholders

5) To supervise management as members of the Nominating, Audit and Compensation Committees

3.Inside Directors

(1) Stance Concerning Roles of Inside Directors and Selection of Candidates.

1) An inside director who is not concurrently an executive officer and who has the ability to ensure the quality of audits is selected as a full-time Audit Committee member.

The inside director who serves as a full-time Audit Committee member should have extensive management experience as an executive officer of the Company in order to improve the effectiveness of the Audit Committee. The qualifications required in particular are experience in accounting and finance or internal audit, business management and core business management.

This inside director also serves as the Nominating Committee member and Compensation Committee member.

2) They are held accountable for their execution and contribute to energetic and meaningful strategic discussions at Board of Directors meetings. Requirements for these inside directors include responsibility for overseeing major elements of the Company’s operations such as strategic planning, accounting and finance, technology, as well as for overseeing main business operations in the Company.

Description in the Reference Materials for the General Meeting of Shareholders (The 121th Ordinary General Meeting of Shareholders)

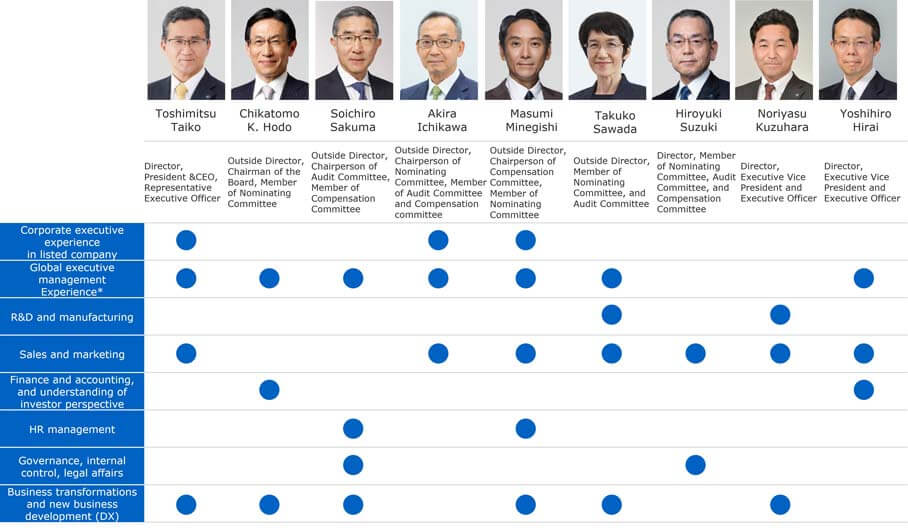

1. Expertise and experience expected of candidates for Directors (skills matrix)

Director Skills Matrix

* “Global executive management experience” includes both actual experience at a global business and experience relating to overseas business operation.

Reasons for Selecting the Expertise and Experience Expected of Candidates for Director

| Expected expertise and experience | Reasons for selection |

|---|---|

| Experience of top management in listed companies | To fulfill supervisory and advisory functions by leveraging experience and insight gained as a Chief Executive Officer, including engagement with shareholders and investors, in order to improve the quality of management strategy and overall corporate management. |

| Global management *"Global management" includes overseas business experience |

To contribute to the oversight and advisory functions for global business expansion and group governance by leveraging an understanding of complex business environments, diverse cultures, and hands-on experience in international operations. |

| Manufacturing Industry: Industries related to our company's business |

To fulfill supervisory and advisory functions based on knowledge and insight into trends, regulations, and challenges in the manufacturing sector or industries related to the Company's business, for the purpose of sustainable expansion and growth of our company's business. |

| Technology, R&D, manufacturing | To function in a supervisory and advisory capacity in providing high value-added products and services as a manufacturer, continuously providing differentiated value based on technology, and formulating and implementing production strategies. |

| Sales and marketing | To function in a supervisory and advisory capacity in formulating and implementing sales and marketing strategies in keeping with changes in the business environment and diversifying customer needs. |

| Finance and accounting, and understanding of Investor perspective | To function in a supervisory and advisory capacity in building a sound financial foundation, making strategic investments over the medium to long term, and achieving shareholder returns. |

| HR management | To function in a supervisory and advisory capacity in maximizing human capital and implementing corporate culture reforms for the sustainable growth of the Company. |

| Governance, internal control, legal affairs | To function in a supervisory and advisory capacity in ensuring the transparency, appropriateness, and effectiveness of management by complying with laws, regulations, and corporate ethics, and by establishing and operating offensive and defensive governance and internal controls. |

| Business transformation and new business development | To function in a supervisory and advisory capacity in transforming the Company itself and transforming our business by utilizing data and digital technology, and in accelerating new businesses development. |

2. Reasons for Selecting the Candidates for Directors

Board Director and President

Toshimitsu Taiko

Mr. Toshimitsu Taiko has held key positions in the Company’s core Business Technologies domain, including CEO of the U.S. sales subsidiary, General Manager of various business headquarters, and Executive Officer overseeing the Business Technologies Business. He also served as Executive Officer in charge of Corporate Planning and Investor Relations, focusing on enhancing the corporate value of the Group.

To make a clean break from the past and return the Company to a growth trajectory through the selection and concentration of businesses, he launched the Medium-Term Management Plan in 2023, focusing on “strengthening business profitability,” “reinforcing the earnings base,” and “enhancing business management systems.” Under this plan, he drove the divestment of non-core businesses and advanced global structural reforms. His strong commitment to delivering on promises is a cornerstone of the Company’s growth and transformation. In fiscal 2025, under the policy of "Turn Around 2025," he is leading the entire organization with the goal of restoring the Company to a highly profitable enterprise.

The Company believes that Mr. Taiko will contribute effectively to important management decisions as Director, President, and CEO at the Board of Directors’ meetings and has therefore nominated him as a candidate for Director.

Outside Director

Soichiro Sakuma

At Nippon Steel Corporation and Nippon Steel & Sumitomo Metal Corporation (currently Nippon Steel Corporation), Mr. Sakuma was involved for many years in management in the manufacturing sector and was in charge of main head office functions, including general administration, human resources, environment and IT, mainly in legal and internal control and audit. He has extensive experience and a broad range of knowledge as a corporate executive. In addition, Mr. Sakuma has a high degree of independence from the Company.

Following his election as a Director in June 2020, Mr. Sakuma has performed well as a member of the Board of Directors and other committees. Fiscal 2023 activities are listed in “Primary activities of outside directors and a summary of the tasks performed on the expected roles” in the business report at the Company, he has been instrumental in the Board of Directors and its committees since his appointment as a director in June 2020.

In fiscal year 2024, he has served in this capacity with sufficient time as described in the Business Report, "Primary Activities of Outside Directors and a Summary of the Tasks Performed in the Expected Roles."

Therefore, the Company expects that Mr. Sakuma can continue to contribute to the maintenance and upgrade of its corporate governance as before and has nominated him as a candidate for Director.

Outside Director

Masumi Minegishi

Mr. Minegishi has led the transformation of Recruit Holding Co., Ltd. into a global tech company though the expansion of the human resources business into the information business and digitalization and globalization. In addition to his wealth of management experience and broad insights as a top leader of companies with DNA related to the commercialization of IT services and business development capabilities, he has a high degree of independence from the Company.

Following his election as a Director in June 2022, Mr. Minegishi has performed well as a member of the Board of Directors and other committees.

In fiscal 2024, as stated in the business report under “Primary Activities of Outside Directors and a Summary of the Tasks Performed in the Expected Roles,” Mr. Minegishi has fulfilled his duties with appropriate time commitment.

Therefore, the Company expects that Mr. Minegishi can continue contributing to the maintenance and upgrade of its corporate governance as before and has nominated him as a candidate for Outside Director.

Outside Director

Takuko Sawada

Ms. Sawada has played a central role in promoting the previous and current medium-term business plan at Shionogi & Co., Ltd. and has also focused on establishing global functions and collaboration with industry, government, and academia in Japan and overseas. In addition to her extensive global experience and insight in R&D, management strategy formulation, new business development DX promotion, and more, she has a high degree of independence from the Company.

Following her election as a Director in June 2023, Ms. Sawada has performed well at the Company as a member of its Board of Directors and other committees.

In fiscal 2024, as described in the Business Report titled “Primary Activities of Outside Directors and a Summary of the Tasks Performed on the Expected Roles,” Ms. Sawada has devoted sufficient time and attention to fulfilling her responsibilities. She was selected as Chairperson of the Board of Directors for meeting the requirements stipulated in the Company’s Basic Policy on Corporate Governance, and for being well-qualified to lead discussions on medium- to long-term growth strategies, drawing on her technical expertise in the Company’s growth areas as well as her extensive managerial experience.

Therefore, the Company expects that Ms. Sawada can continue to contribute to the maintenance and upgrade of its corporate governance as before and has nominated her as a candidate for Outside Director.

Outside Director

Saeko Arai

Ms. Arai has specialized expertise in finance and accounting, and has served as a Chief Financial Officer (CFO) at global companies. She has also gained extensive experience as an auditor and director at multiple companies, and possesses deep knowledge of corporate governance and internal controls.

The Company expects that she will apply the insight and analytical skills cultivated through her experience to the formulation of medium- to long-term financial strategies for sustainable growth. As an executive with an international perspective, she is also expected to contribute to maintaining and enhancing our corporate governance. Accordingly, the Company has nominated her as a candidate for Outside Director.

Outside Director

Yoshihiko Kawamura

At Hitachi, Ltd., Mr. Kawamura demonstrated outstanding capabilities in formulating and executing financial strategies as Chief Financial Officer (CFO). At Mitsubishi Corporation, he gained valuable experience and built extensive networks across a wide range of industries, including the electronics sector.

Drawing on his background in driving the strategic selection and focus of globally diversified manufacturing businesses, he brings important perspectives on maximizing shareholder value while maintaining financial soundness and achieving sustainable growth. The Company expects that he will contribute to the maintenance and enhancement of our corporate governance, and has therefore nominated him as a candidate for Outside Director.

Please refer to pages 55 and 56 of the business report for “Primary Activities of Outside Directors and a Summary of the Tasks Performed on the Expected Roles.

Please refer to the following for the “Primary Activities of Outside Directors and a Summary of the Tasks Performed on the Expected Roles” in the Business Report (pages 55 and 56):

https://www.konicaminolta.com/jp-ja/investors/event/pdf/meeting_121_inv.pdf

Director

Hiroyuki Suzuki

The Company believes that it is important for the Audit Committee to include a full time Inside Director who has extensive business management experience and expertise involving the collection of information.

Mr. Suzuki will attend management meetings of Executive Officers as a member of the Audit Committee. He will work to optimize the quality and quantity of information for the audit by the Committee as he will grasp and confirm validity of the determination process about operations, which are commissioned to the Executive Officers by the Board of Directors, as well as the operational status of the internal control system and will provide the Audit Committee with feedback on such information.

After engaging in the secretariat duties to support the Audit Committee at the Audit Committee Office of the Company, Mr. Suzuki has also overseen internal audit as the General Manager of the Company’s Corporate Audit Division. Mr. Suzuki has extensive experience and considerable expertise related to internal control. Since 2019, he has focused on management oversight as an Inside Director not concurrently serving as an Executive Officer. In addition to the Audit Committee, he also properly fulfills his duties as an inside member of the Nominating and Compensation Committees.

Therefore, the Company believes that Mr. Suzuki can continue enhancing corporate value by securing the effective operation of its corporate governance and has nominated him as a candidate for Director.

Director

Noriyasu Kuzuhara

The Company believes that it is important to select Executive Officers in title who are in charge of primary duties so that they can engage in active and essential discussions at meetings of the Board of Directors.

Mr. Kuzuhara has achieved continuous business growth as the officer responsible for technology development and business in the Company’s core performance materials business, and as Division President of the Material & Component Business Headquarters.

During his tenure as Managing Executive Officer in charge of corporate planning, he aimed to transform the organization into one with high per-capita productivity based on efficiency improvements in all operations and human resource enhancement, leading the planning of global structural reform measures and delivering results.

Since fiscal 2024, leveraging his extensive knowledge of technology, research and development, and manufacturing, along with his experience in launching businesses, Mr. Kuzuhara has been striving to enhance our group's corporate value as the executive in charge of the Industry Business, a strengthened area, to accelerate the execution of its strategy.

The Company believes Mr. Kuzuhara can demonstrate accountability to the Board of Directors and participate in important management decisions. Therefore, the Company has nominated him as a candidate for Director.

Director

Yoshihiro Hirai

The Company believes that it is important to select Executive Officers in title who are in charge of primary duties so that they can engage in active and essential discussions at meetings of the Board of Directors.

Mr. Hirai has a high level of expertise and extensive experience in finance and accounting, as well as knowledge of financial strategy from a global perspective. As Managing Executive Officer, he is in charge of accounting, finance, and legal affairs, and serves as the chairperson of the Compliance Committee and the Risk Management Committee. From a corporate finance standpoint, he addresses business challenges and strengthens internal controls, striving to enhance our group's corporate value through the promotion of the medium-term management plan.

The Company believes Mr. Hirai can demonstrate accountability to the Board of Directors and participate in important management decisions. Therefore, the Company has nominated him as a candidate for Director.

Executive System and Appointment of Executive Officers

Executive System

- Under a mandate from the Board of Directors, executive officers make decisions about operations and then execute them. Business execution is overseen by the Board of Directors and reviewed by the Audit Committee to ensure the efficiency, adequacy, legality, and soundness of management.

- Executive officers are appointed by the Board of Directors, which selects the President and senior executive officers from among the executive officers, and establishes a division of duties among them. The executive officers, including the President, make decisions concerning the execution of duties delegated by the Board of Directors, and execute their duties.

Selection or Dismissals of Executive Officers

- The Board of Directors uses a fair, timely, and appropriate method to select people who have the capabilities to serve as executive officers. These individuals must be able to create new value for the Group and earn the support of internal and external stakeholders. Standards for making these judgments about capabilities are defined in “Standards for the Selection of Executive Officers.”

Individuals must have the ability and experience for the internal and external management of the Group's business operations. Qualification standards also take into consideration knowledge about specialized fields and technologies, an individual's age when the time for renewing the appointment comes, and other items. In addition, the Board of Directors selects individuals with a strong commitment to ethics, the ability to put customers first, the ability to drive innovation, strong motivation to achieve goals, and other such characteristics. - To select new executive officers, candidates who have completed senior executive candidate training must pass through the first stage of the selection process, which involves submitting documents and completing an interview. Next, an assessment is performed in order to reach a highly objective and appropriate decision. This process includes input from both an external perspective and from the perspective of people at the Group who frequently interact with these candidates as part of their jobs. An evaluation conference, which consists of the President and the executive officer responsible for personnel, is held to examine the results of this process. This results in the selection of candidates to become executive officers.

- To determine the new team of executive officers, the President selects from the list of executive officer candidates the individuals believed to be well suited to serve as executive officers. Next, a proposal for the selection of executive officers for the new fiscal year is prepared and submitted to the Board of Directors, with a list of the duties for each executive officer.

- Prior to the submission of this proposal to the Board of Directors, the Nominating Committee performs oversight of the entire process, including a confirmation that a suitable process was used. Oversight includes receiving the proposal for the new executive officer team (including the proposed new executive officer selections from the President) and a report about the proposed duties of each executive officer.

- The Nominating Committee considers observing the character of executive officer candidates to be an important matter and utilizes opportunities such as attending meetings of the Board of Directors and reporting to informal gatherings of directors. After receiving the proposal for the selection of executive officers mentioned above from the President, the Nominating Committee discusses the content of the proposal, creates a summary of its conclusions regarding matters such as the appropriateness of candidates and training issues, and provides these as feedback to the President.

- The Board of Directors takes the “Standards for the Selection of Executive Officers” into full consideration when deciding whether or not to dismiss an executive officer.

Compensation for Directors and Executive Officers

The Company, which has adopted the company-with-three-committees system, has established a Compensation Committee. Outside directors account for the majority of members of the committee and the committee is chaired by an outside director to ensure transparency and to determine compensation in a fair and appropriate manner. The Company’s directors’ compensation system is intended to strengthen the motivation of directors and executive officers to strive for the continuous medium-to-long-term improvement of the Group’s performance in line with management policies, to meet shareholder expectations and contribute to the optimization of the Group’s value. The Company aims for a level of compensation that enables it to attract and retain talented people to take responsibility for the Company’s development.

In keeping with these aims, the Compensation Committee has established a policy for determining the individual compensation entitlement of directors and executive officers and determines the amount of individual compensation entitlement of directors and executive officers in line with this policy.

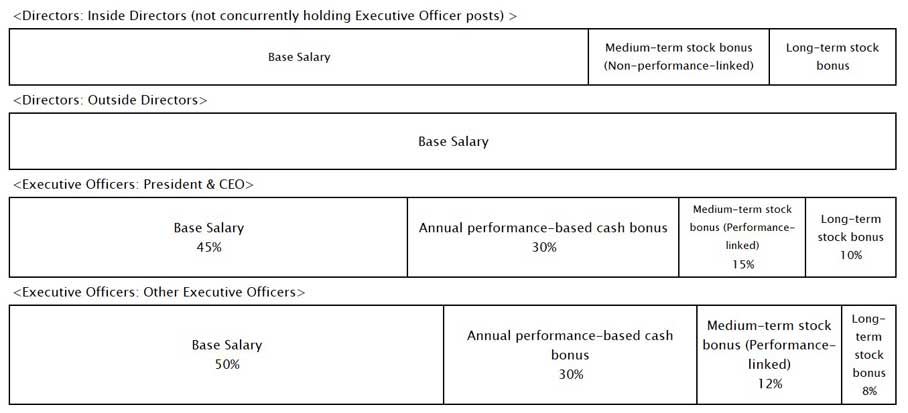

Compensation Policy (Fiscal 2024)

- Compensation system (see diagram below)

1) Compensation packages for directors (excluding directors who concurrently hold executive officer posts) exclude a short-term performance-based cash bonus because directors have a supervisory role and consist of a base salary and stock compensation. The stock compensation consists of a medium-term stock bonus (non-performance-based) and a long-term bonus.

Only a role-specific base salary is provided to outside directors.2) Compensation packages for executive officers consist of a base salary, an annual performance-based cash bonus, which reflects the performance of the Group, as well as stock compensation. The stock compensation consists of a medium-term stock bonus (performance-based) and a long-term stock bonus.

- The total amount of individual compensation entitlement and base salary are set at an appropriate level, taking into account position and value of the job, by considering value based upon objective data, evaluation data and other data collected at regular intervals.

- The amount of “annual performance-based cash bonus” shall be determined based on the level of performance in the relevant fiscal year (consolidated operating profit), the degree of achievement of annual performance targets, and the progress of each Executive Officer in advancing strategically important policies. The amount based on the degree of attainment of annual performance targets is determined in the 0% to 200% range of the standard amount of compensation. The targets are major consolidated performance indicators (profit for the year, total asset turnover ratio and KMCC-ROIC*) associated with results of operations.

*Return on invested capital is used for calculating the annual performance-based cash bonus, and the invested capital represents the assets that can be individually managed and grown by each business division.

- Stock bonus plan

1) In the medium-term stock bonus (non-performance-based) plan for directors, the Company's shares are distributed to directors upon the conclusion of the Medium-Term Business Plan, according to their roles and years in office. The plan is designed to enhance directors' motivation to contribute to medium-term shareholder value improvement and to promote their ownership of the Company's shares.

2) In the medium-term stock bonus (performance-based) plan for executive officers, the Company's shares are distributed to executive officers upon the conclusion of the Medium-Term Business Plan in the 0% to 200% range. The plan is designed to enhance their incentives for attaining the targets of the Medium-Term Business Plan and promote their ownership of the Company's shares. Medium-term management targets shall consist of important consolidated financial indicators (ROE) taking into account medium-term management policy, as well as non-financial indicators (CO2 emissions reduction by measures and employee engagement score).

3) The long-term stock bonus for directors (internal directors not also serving as executive officers) and executive officers is awarded in the form of Konica Minolta shares after the retirement of the officer concerned and is based on the person's position or role and their tenure. The aim of this compensation is to enhance motivation and to contribute to long-term shareholder value improvement.

4) The standard number of shares is set according to the position each director or executive officer held in the first year of the Medium-Term Business Plan.

5) Certain portions of shares are distributed in cash on the assumption that they are exchanged for cash.

6) Shares of the Company obtained as stock bonus shall be held in principle for one (1) year after the date of retirement from the post of each director or executive officer.

- The standard for compensation of the president and chief executive officer is a 45:30:25 mix of a base salary, an annual performance-based cash bonus, and a medium-term performance-based stock bonus. For the other executive officers, the base salary ratio is set higher than that for the president.

In addition, the ratio of the medium-term stock bonus (performance-based) and long-term bonuses within the stock compensation shall be 60:40. - Compensation for non-residents of Japan may be handled in different ways from the above-mentioned treatment above due to legal and other circumstances.

- If the Board of Directors must resolve a correction to financial statements after they are announced due to a material accounting error or fraud, the Compensation Committee shall consider corrections to performance-based bonuses and limit payment or request return of the bonuses when necessary (so-called “claw back clause”).

- The Company reviews levels, composition, and other elements of compensation in a timely and proper manner in accordance with changes in the management environment.

Furthermore, at the Compensation Committee meeting held on April 28, 2025, a resolution was passed to adopt Total Shareholder Return (TSR) as an evaluation metric for stock-based remuneration. In anticipation of the Company’s management direction and strategy from fiscal 2026 onward, following the current medium-term management plan, it was confirmed that the TSR evaluation period would begin in fiscal 2025, with the aim of further enhancing officers’ incentives to improve the Company’s stock price starting from that year.

Compensation System Diagram

Directors: Inside Directors (not concurrently holding Executive Officer posts)

Base salary

Medium-term stock bonus (Non-performance-based)

Long-term stock bonus

Directors: Outside Directors

Executive Officers: President & CEO

Annual performance-based cash bonus

Medium-term stock bonus (Performance-based)

Executive Officers: Other Executive Officers

Indicators for Performance-based Bonuses, Reasons for the Selection of These Indicators, and Method for Determining the Amount of Performance-based Bonuses

1. Annual Performance-based Cash Bonus

(1) Overview (Items and Indicators)

| Item | Portion according to performance level | Portion according to attainment of performance targets | Portion according to personal appraisal | ||

|---|---|---|---|---|---|

| Assessment index and others | 20% | 40% | 40% | ||

| Operating profit | Profit for the year | Total Asset Turnover | KMCC-ROIC | Reflects progress of each executive officer’s key measures | |

| 40% | 30% | 30% | |||

| Linked with Group consolidated performance result level | Linked with annual performance target attainment rate | ||||

Note:1. Component ratios are theoretical values based on design.

2. KMCC-ROIC is the ROIC used to calculate the annual performance-based cash bonus for the relevant fiscal year and uses assets that can be individually managed and improved by each business unit as invested capital.

(2) Indicators for performance-based bonuses, reasons for the selection of these indicators

1) The indicator for the level of performance results portion is the amount of Group consolidated operating profit. It was judged that operating profit is the most appropriate indicator for determining the responsibility for performance that should be taken on by executive officers with the aim of realizing sustainable growth and enhanced corporate value by achieving higher levels of operating profit.

2) The indicators for the portion according to attainment of performance targets are the amount of profit for the year, total asset turnover ratio, and KMCC-ROIC. These indicators attach strong significance to the Company’s sustainable growth and the enhancement of the medium- to long-term corporate value. Current profit, was selected in order to improve ROE by achieving a fundamental recovery in profitability and to secure funds for dividends, total asset turnover was chosen with the aim of reducing total assets and interest-bearing debt while ensuring cash allocation, while KMCC-ROIC was selected to increase the efficiency of invested capital.

3) The reason for this is that the “Individual Evaluation” uses indicators to assess the progress of each Executive Officer’s strategic priority policies and targets, employing perspectives and items that are different from those of the “Performance Level” and “Achievement of Performance Targets.” In particular, we ensure the timely and appropriate implementation of measures strategically necessary to improve our corporate value in the medium- to long-term, even if they do not appear in financial indicators or are accompanied by a temporary deterioration of financial indicators. For the portion according to personal appraisal, factors such as the progress of each executive officer’s key operational measures are used as indicators. Matters are evaluated from a different perspective than the performance results portion and the portion according to the attainment of performance targets.

(3) Method for deternining compensation amount

1) The amount paid for the level of performance results portion is calculated by multiplying a value determined according to the amount of Group consolidated operating profit by a number of points set for each position. Said value is decided in accordance with a table formulated in advance.

2) The amount paid for the portion according to attainment of performance targets is calculated by multiplying the payment rate calculated from the annual performance target attainment rate (calculated based on the weighting of each indicator) by a set amount according to position. This is intended to leverage the combined power of all our Executive Officers toward the group’s optimal solution by applying the Group’s Executive Officers to its consolidated performance on a joint basis. The rate of the payment varies from 0% to 200%, depending on the attainment level of the target.

3) The “Individual Evaluation” is calculated by multiplying the standard amount for each position by the evaluation of the state of achievement of strategic priority policies for each Executive Officer, which is drafted by the President & CEO (the evaluation ranges from 0% to 200%, taking 100% as a base). In order to ensure objectivity and fairness in this evaluation, the Compensation Committee shall receive an explanation from the President & CEO at the beginning of each fiscal year of each Executive Officer’s strategic priorities and targets and confirm consistency with the annual management plan outline and medium-term business plan determined by the Board of Directors.

4) The payment amounts in the three items listed above will be discussed and settled by the Compensation Committee.

2. Medium-term Stock Bonus (Performance-based)

(1) Overview (Items and Indicators)

| Item | Medium-term stock bonus (performance-based) | ||

|---|---|---|---|

| Assessment Index * All items are based on the Group |

Group consolidated financial indicators | Non-financial indicators | |

| ROE | The CO2 emissions reduction rate | Employee engagement score | |

| 80% | 10% | 10% | |

| Linked with attainment rate of medium-term business plan targets | |||

(2) Indicators and the reasons for the selection of these indicators

In order to achieve sustainable growth and increase corporate value over the medium- to long- term, we use ROE as a financial indicator, and our CO2 emission reductions through measures and employee engagement score as non-financial indicators (all on a group-wide basis). ROE was selected to enhance profitability from an investor’s perspective. The amount of CO2 emissions reduction achieved through initiativesachieved through measures was selected to link environmental value to business growth while addressing the social issue of climate change, and the employee engagement score was selected to maximize performance by developing and acquiring human resources and strengthening organizational capabilities.

(3) Methods for determining the amount of compensation

1) The number of stock to be distributed is determined by multiplying the payment rate calculated from the target attainment rate in the final fiscal year of the medium-term business plan, reflected with the weighting of the indicator, by the number of points set for the position accumulated over the same period, with one point equaling one share that will be transferred as compensation.

The rate of the payment varies from 0% to 200%, depending on the attainment level of the target.

2) Points set per position is calculated by dividing the amount of resources allocated per position by a reference stock price.

3) The reference stock price shall be the average stock price for the first three months of the medium-term business plan period.

4) The number of shares transferred listed above will be discussed and settled by the Compensation Committee

Activities of the Compensation Committee, etc.

| Month | Attendance | Main agenda items ◆: Resolution adopted ◇: Deliberated ◯: Reported △ :Other |

|---|---|---|

| April 2024 | All 4 attended | ◆ Revision of non-financial metric for medium-term stock compensation (performance-based): "CO2 Emissions Reduction Achieved through Measures” ◆ Partial revision of the Policy for Determining Compensation and internal rules for executive compensation ◇ Study of executive compensation system |

| May 2024 | All 4 attended | ◆ Annual performance-based monetary compensation for Executive Officers in FY2023 ◆ Stock compensation for Executive Officers in FY2023 ◆ Individual compensation amount (Base Annual Salary) for Executive Officers in FY2024 ◆ Partial revision of the Policy for Determining Compensation and internal rules for executive compensation ◯ Strategic priority policies for Executive Officers in FY2024 |

| June 2024 | All 4 attended | ◆ Selection of Committee Chair ◆ Compensation Committee’s annual policy and plan for 2024 ◆ Compensation (standard annual salary) by individual executive since July 2024 |

| July 2024 | All 4 attended | ◇ Study of executive compensation system ◆ Partial revision of the Policy for Determining Compensation ◯ Direction regarding the number of shares to be acquired for stock-based compensation |

| November 2024 | All 4 attended | ◇ Study of executive compensation system |

| November 2024 | All 4 attended | ◯ President’s assessment of each executive officer’s strategic priorities for the first half of FY2024 |

| March 2025 | All 4 attended | ◆ Individual compensation for executive officers in FY2025 (base annual salary) ◇ Study of outside director compensation system ◆ Number of additional shares to be acquired through trust-based stock compensation |

| April 2025 | All 4 attended | ◆ Introduction of TSR as an evaluation indicator for the FY2026 medium-term performance-based stock compensation plan |

| May 2025 | All 4 attended | ◆ Amount of annual performance-based cash bonuses for executive officers in FY2024 ◆ Stock compensation for executive officers in FY2024 ◆ Partial revision of executive compensation internal rules ◯ Key strategic initiatives for executive officers in FY2025 ◇ Approach to designing the TSR evaluation scheme in the Compensation Committee's FY2025 annual plan |

Amount of Compensation Paid to Directors and Executive Officers for the Year Ended March 2025

| Total | Fixed compensation | Performance-based compensation | Stock bonus | |||||

|---|---|---|---|---|---|---|---|---|

| Persons | Amount | Persons | Amount | Persons | Amount | |||

| Directors | Outside | 90 | 5 | 90 | - | - | - | - |

| Inside | 40 | 1 | 32 | - | - | 1 | 8 | |

| Total | 130 | 6 | 122 | - | - | 1 | 8 | |

| Executive Officers | 611 | 13 | 336 | 13 | 133 | 13 | 141 | |

Notes

1.As of March 31, 2025, there are five outside directors, one internal director (not concurrently serving as an executive officer), and 13 executive officers.

2.In addition to the one internal director mentioned above, there are three internal directors who also serve as executive officers, and their compensation is included in the compensation for executive officers.

3.Regarding the performance-based compensation, the amounts to be recorded as expenses for the fiscal year are stated. The calculation method is described in '1. Annual Performance-Based Monetary Compensation' and '(3) Method for Determining Compensation Amount.' The 'performance level component' and the 'performance target achievement component' are calculated based on estimated results as of the fiscal year-end and recorded as expenses. For the 'individual evaluation component,' the standard amount is recorded as an expense, while the actual payment is determined by the Compensation Committee based on the implementation status of each executive officer’s strategic priority initiatives established at the beginning of the fiscal year.

4.Regarding stock-based compensation, the amounts recorded as expenses for the fiscal year are based on the estimated number of points to be granted to directors (excluding outside directors) and executive officers, and reflect the expected value of future share-based grants. These amounts also include the estimated value of medium-term performance-based stock compensation to be delivered in proportion to the achievement rate of the targets set in the medium-term business plan.

Persons whose total compensation was over 100 million yen or more in fiscal 2024 are as follows.

| Position/Name | Company category | Total | Fixed compensation | Performance-based compensation (Note 2) |

Stock bonus (Note 3) |

|---|---|---|---|---|---|

| Representative Director, President and CEO, Toshimitsu Oyuki |

Submitting company | 135 | 74 | 35 | 25 |

Notes

Regarding performance-based compensation, please see (Note 3) above, and for stock-based compensation, it is the same as ___ (Note 4) above.

Group Auditing System

Creating a System That Aims for Effective Audits

Konica Minolta Inc., which has adopted the company-with-committees system, has established an Audit Committee, while its subsidiaries in Japan have appointed their own respective auditors. In addition, Konica Minolta Inc., has a Corporate Audit Division, which conducts an internal audit of the entire Group.

The members of the Audit Committee and the Corporate Audit Office, as well as auditors of the subsidiaries in Japan, share related information and strengthen the coordination of audit activities across the Group. With the aim of ensuring effective audits, the same parties hold regular meetings with the accounting auditors, review auditing systems and policies, and examine whether or not the accounting auditors can fulfill their tasks properly.

The members of the Audit Committee and the Corporate Audit Division, as well as auditors of the subsidiaries in Japan, share related information and strengthen the coordination of audit activities across the Group. With the aim of ensuring effective audits, the same parties hold regular meetings with the accounting auditors, review auditing systems and policies, and examine whether or not the accounting auditors can fulfill their tasks properly.

Audit Committee System and Roles

The Audit Committee is comprised of four directors (who do not hold positions as executive officers), three of whom are outside directors. The Chairperson of the Audit Committee is selected from among the outside directors. To ensure effective operation of the committee, it has established its own office (Audit Committee Office) with staff members who are independent of any sections committed to actual business operations. The Audit Committee members evaluate the legality and validity of the management decisions made by directors, executive officers and, monitor and validate internal control systems, assess the adequacy of the accounting auditors, and determine the agenda of the general meeting of shareholders regarding the appointment and dismissal of accounting auditors. In principle, a committee meeting is held before the meeting of the Board of Directors, so that the committee members can present their opinions to the meeting of the Board of Directors, if deemed appropriate.

Corporate Audit Office Systems and Role

The Company has set up the Corporate Audit Office to be responsible for the internal audit of the entire group and to perform internal audits of the Company and its subsidiaries as an organization under the direct control of the President. The Corporate Audit Office has established a dual reporting line and reports to the President and the Audit Committee, and the Chairperson of the Audit Committee reports the contents of the Audit Committee report to the Board of Directors accordingly. Using the risk assessment approach, the division evaluates these companies in terms of the reliability of their financial statements, the efficiency and effectiveness of their business operations, their legal compliance, and the protection of assets. It also conducts follow-up audits to verify what improvements have been made in response to audit findings. Furthermore, we have established internal audit departments in major subsidiaries, and are strengthening the internal audit function of the group while coordinating with the Corporate Audit Office. Additionally, major subsidiaries have their own internal audit divisions that work closely with the Corporate Audit Division of Konica Minolta Inc. to enhance the internal audit function of the entire Group.

IR Newsletter

※Clicking the link above will take you to the“Mitsubishi UFJ Trust and Banking Corporation”website.

Most Viewed

- Financial Results / Presentation Materials FY2025

- Other Events

- IR Events

- Integrated Report (Annual Report)

- IR Materials

Period : 01/01/2026 to 31/01/2026