Medium-term Business Plan Update

Basic Policies of the Medium-Term Business Plan and Business Positioning

Return to a highly profitable company through business selection and concentration

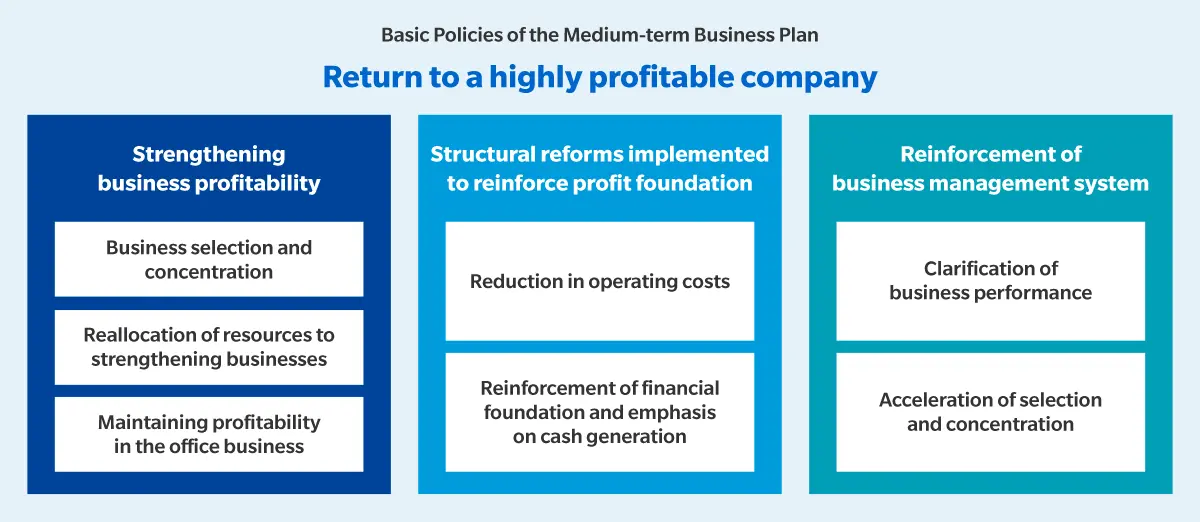

In this Medium-term Business Plan, we aim to achieve our financial and non-financial targets, chart a growth trajectory and return to being a highly profitable company through the following three initiatives: strengthening business profitability, structural reforms implemented to reinforce profit foundation, and reinforcement of business management system.

When it comes to strengthening business profitability, we are focused on selecting and concentrating our businesses,pursuing growth in strengthening businesses, and reinforcing profitability of the office business to increase business contribution profits. In regard to reinforcing our profit foundation, we are reducing operating costs by implementing structural reforms, in addition to selecting and concentrating businesses.

With respect to reinforcing our business management system, we are working to establish mechanisms that clarify business performance and accelerate the selection and concentration of businesses.

Review business positioning to select and concentrate businesses

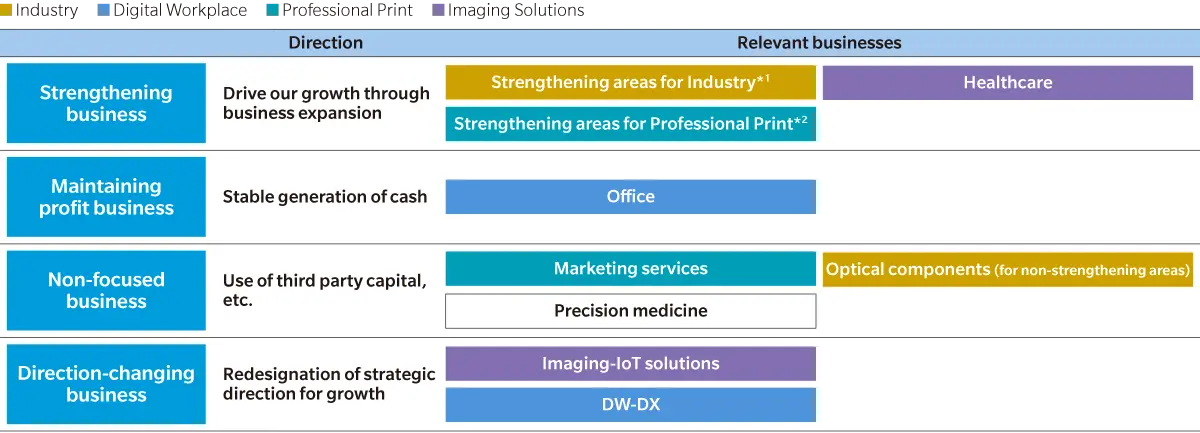

To select and concentrate businesses, this Medium-term Business Plan repositions all business units under one of four categories—strengthening, maintaining profit, non-focused, and directionchanging businesses—and clarifies the expectations and roles of each unit.

Strengthening businesses will drive Konica Minolta’s growth through further business expansion. Maintaining profit businesses will ensure stable cash generation and further strengthen earnings power. Non-focused businesses are those whose role will be determined from a best-owner perspective, with a view to using third-party capital. Direction-changing businesses will reorient all or parts of their business, and get placed on a growth trajectory after undergoing their selection and concentration.

Business Positioning

*1 Strengthening areas for Industry: sensing + performance materials + IJ components + optical components (industrial applications)

*2 Strengthening areas for Professional Print: production print + industrial print

Results of Fiscal 2024 Management Reforms

In fiscal 2023-2024, completed management

reforms aimed at breaking with the past

In fiscal 2024, we undertook numerous management reforms and successfully completed all planned measures.

Business Selection and Concentration

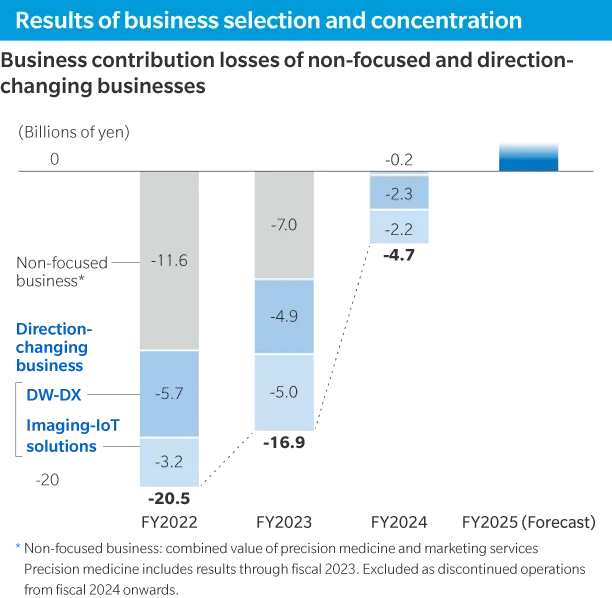

For non-focused businesses, we concluded all transfer agreements in precision medicine; a transfer agreement for overseas MPM services* in marketing services; and a transfer agreement of equity interest of one Chinese manufacturing subsidiary in optical components.

For direction-changing businesses, we narrowed down the countries and regions in which DW-DX services are offered. For Imaging-IoT solutions, we narrowed down the countries and regions in which we operate, implemented structural reforms in Europe and the U.S., and concluded a transfer agreement for MOBOTIX. These measures will reduce losses in non-focused and direction-changing businesses, with profitability expected by fiscal 2025.

* MPM: Marketing Print Management. A service for marketing departments in major global companies.

Reinforcement of profit foundation

In the Business Technologies Business, profit is steadily increasing, mainly from our office units. We also established Global Procurement Partners Corp., a joint venture with FUJIFILM Business Innovation Corp., to build a robust supply system for raw materials and parts. In addition, from a production efficiency standpoint in the business technologies sector, we discontinued production at our Wuxi, China factory, and relocated production sites to Dongguan, China, as well as Malaysia and Japan. By restructuring our production system, we aim to optimize it and diversify our global supply network.

By optimizing human capital and promoting DX, we expect global structural reforms to have effects that exceed our initial plans.

In addition, to strengthen our financial base, we are working to reduce interest-bearing debt mainly by using the cash obtained from business transfers, and are progressing as planned toward the end of fiscal 2025.

We recognize the deterioration in profitability and delayed growth in certain business units designated as strengthening initiatives in our Mid-term Business Plan as management challenges and will continue to accelerate efforts to improve them.

Results of business selection and concentration & reinforcement of profit foundation

Strengthening business management systems

Under reinforcing our business management systems, we are working to build foundations supporting growth, such as improving impairment signs monitoring and reviewing new business development processes, as well as transforming corporate culture.

Results of reinforcing our business management systems

Results of business selection and concentration & global structural reform

Reduced business contribution losses by transferring non-focused businesses

and redesigning strategy of direction-changing businesses

For non-focused businesses, we considered using third-party capital and, as mentioned above, concluded transfer agreements for the precision medicine, marketing services, and optical components units, and expect to complete all transfers within fiscal 2025. For direction-changing businesses, we revised growth strategies for DW-DX and Imaging-IoT solutions and executed reform measures.

In fiscal 2022, prior to the current Medium-term Management Plan, non-focused and direction-changing businesses combined for 20.5 billion yen in business contribution losses. However, as a result of these measures, the loss was significantly reduced in fiscal 2024, to 4.7 billion yen. We plan to be profitable in fiscal 2025.

Achieved cost reductions through the completion of global structural reforms

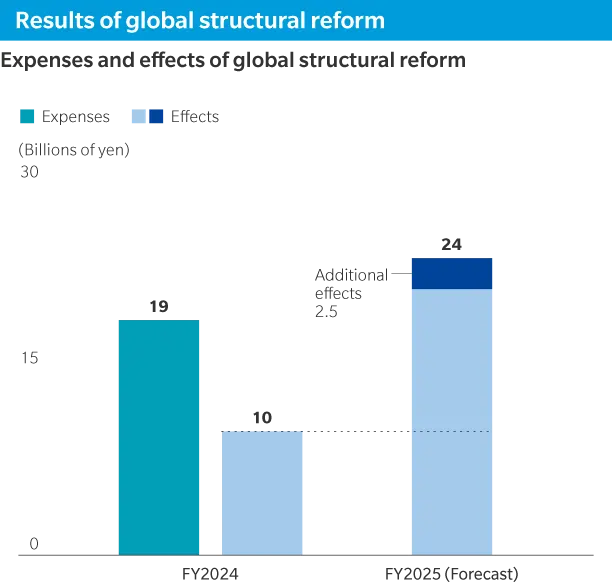

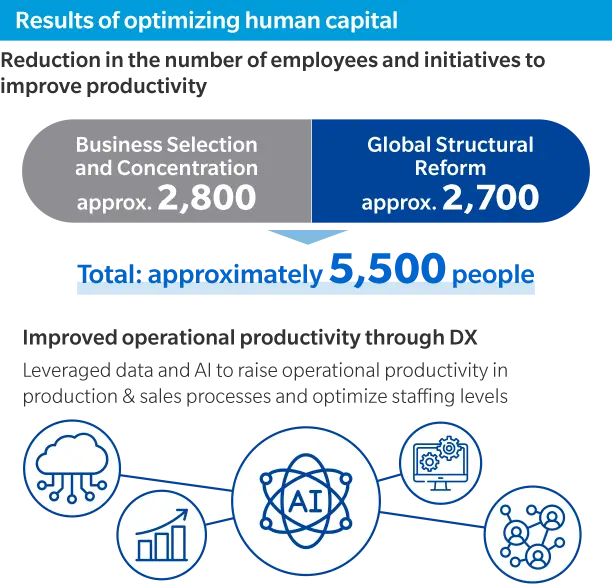

To improve the entire group’s productivity, we are aiming to transform into an organization with high per capita productivity by optimizing human capital as part of global structural reforms while promoting DX.

To optimize human capital, we had planned to reduce our workforce by 2,400 employees relative to initial plans for fiscal 2025, but by executing additional measures in multiple functions and regions, the reduction of Group employees was larger than initially expected.

We had anticipated a one-time expense of about 20 billion yen in fiscal 2024, but we were able to reduce this to about 19 billion yen by implementing additional measures. The effect of these measures improved profits by about 10 billion yen in fiscal 2024. We expect to generate further profit-improvement effects of about 14 billion yen in fiscal 2025, for a total effect of approximately 24 billion yen.

To continue sustainable growth while keeping personnel numbers down, we are advancing higher operational productivity with DX. Specifically, we are automating operations by leveraging generative AI and shifting employees to high added-value tasks that only humans can perform.

In areas such as sales, services, production, and development, we promoted the use of digital data and AI to raise the quality and efficiency of our operations, thereby aiming to enhance productivity and customer service. In fiscal 2025, we plan to actively promote the DX initiatives, selected from among our many DX themes, that will yield a high return on investment. With DX, we will improve profitability and prepare to invest in future growth areas.

Toward a V-shaped recovery in fiscal 2025 and further growth in the future

Turn Around 2025—Aiming for ROE of 5% through business growth and management reform effects

Fiscal 2025, the final year of the current Medium-term Business Plan, will be positioned as Turn Around 2025, and we will build a foundation to return Konica Minolta to a growth trajectory.

For our financial targets, we are prioritizing ROE improvement above all else. We will aim for an ROE of 5% by selecting and concentrating businesses to improve basic earnings margin, optimizing working capital and inventories, and building a well-balanced financial base.

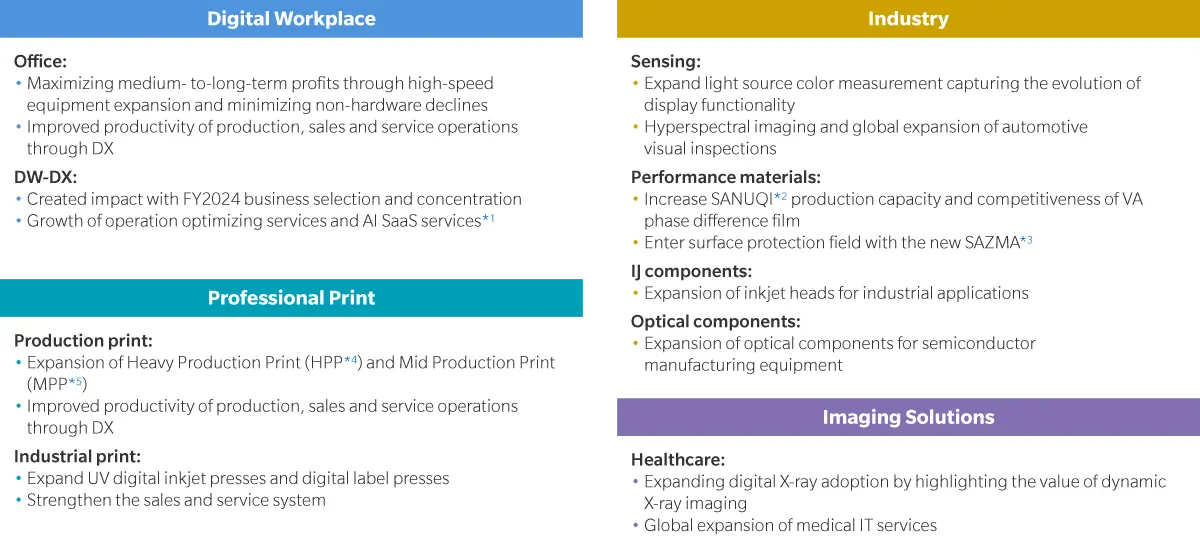

Revenue will be lower than initial plans set in fiscal 2023 due in part to the transfer of businesses as a result selection and concentration, but the business contribution profit ratio is expected to hit the target of 5% or more thanks to the effects of management reforms.

With regard to strengthening businesses, although some businesses are experiencing slow growth, we will identify their respective issues and implement measures to grow each of them. Specifically, in industrial print, we will accelerate growth by introducing new products. In performance materials, we will expand our share in focus areas, and in sensing and healthcare, we will aim to improve profitability.

As non-financial indicators, we are also working to improve employee engagement and reduce CO2 emissions.

In this Medium-term Business Plan, we are prioritizing an ROE of 5%, but at the same time, we are also working to develop technologies that will serve as seeds for future medium- to long-term profit growth. In the next Medium-term Business Plan and beyond, we will aim for an ROE of 8% and further growth, and continue to enhance our corporate value.

| FY2023 Results |

FY2024 Results |

FY2025 Forecast |

FY2025 Medium-term plan (As of Apr 2024) |

|

|---|---|---|---|---|

| Revenue (Billions of yen) |

1,159.9 | 1,127.8 | 1,050.0 | 1,050.0 |

| Business contribution profit | 2.2% | 2.8% | 5.0% | 5% or more |

| ROE | 0.9% | -9.5% | 5% | 5% or more |

| FY2023 Results |

FY2024 Results |

FY2025 Plan |

||

|---|---|---|---|---|

| Employee engagement score | 6.8 | 6.8 | 7.7 | |

| CO2 emissions produced in Konica Minolta product lifecycle |

Reductions compared to 2005 |

63% | 62% | 61% or more |

| Emissions | 750,000 tons | 780,000 tons | 800,000 tons or less | |

| Contribution to CO2 reduction by customers and society |

630,000 tons | 680,000 tons | 800,000 tons or more | |

FY2025 Strategic Challenges and Measures by Business

*1 AI SaaS Services: Services we developed that offer AI-enabled interpretation, knowledge management, and educational support, etc.

*2 SANUQI: Trademark for a new resin film made of COP material, used as a component of electronic display devices. This film has excellent water resistance, heat resistance, and transparency.

*3 SAZMA: Trademark for a new acrylic film used as a component of electronic display devices. This film features easy surface processing and optical isotropy, which are not found in conventional products.

*4 HPP: Heavy Production Print, over 1 million prints/month, commercial printing products.

*5 MPP: Mid Production Print, 300k to 1 million prints/month, commercial printing products.