Message from the CEO

We will break from the past traditions and strive toward a V-shaped recovery in business performance and establishing a foundation for growth.

Toshimitsu Taiko

Director, President and CEO,

Representative

Executive Officer

Review of the Second Year of the Medium-term Business Plan

Completed business selection and concentration

and global structural reforms in the first two years

In fiscal 2023, we launched our three-year Medium-term Business Plan aimed at a “return to a highly profitable company.” During the first two years of the Medium-term Business Plan (fiscal 2023 to 2024), in addition to business selection and concentration, we focused on management reforms with the additional measure of global structural reforms, which was not included in the original plan.

Under business selection and concentration, the positioning of all the Group’s business units was classified into four categories—strengthening businesses, maintaining profit businesses, non-focused businesses, and direction-changing businesses—and the expectations and roles of each unit were clarified. Within the non-focused businesses, we utilized third-party capital and transferred the precision medicine and marketing print management (MPM) services businesses. In the direction-changing businesses, we narrowed down the geographic regions and service areas of our business in the DW-DX unit and Imaging IoT Solutions. We recognize that we were able to implement all of these measures that we had initially planned over a two-year period.

In global structural reforms, we recorded approximately ¥19 billion in business restructuring expenses in fiscal 2024, but expect to gain approximately ¥24 billion in structural reform impact between fiscal 2024 and fiscal 2025. In conjunction with business selection and concentration, our human capital optimization eventually covered approximately 5,500 employees, and we will continue to improve operational productivity and service quality while keeping headcount under control through further DX promotion and applying AI.

In fiscal 2024, we were determined to implement these management reforms in this fiscal year to root out the source of any future issues, and therefore we recorded one-time costs and losses associated with the implementation of these reforms, as well as impairment losses due to the revision of our future business plans. As a result, operating loss was ¥64.0 billion and net loss was ¥47.4 billion. In addition, in the fiscal 2024 accounting audit, our audit firm pointed out the calculation of elimination of unrealized gains in the consolidation adjustment, and ¥11.4 billion was recorded as cost of sales,resulting in a decrease in business contribution profit. Although we recorded an operating loss in fiscal 2024 for the first time since fiscal 2022, we believe that we can now focus our energy on establishing a foundation for growth in fiscal 2025 and beyond by completing our management reforms without postponing structural reforms and business selection and concentration.

Phases of the Medium-term Business Plan

Strengthening the financial base through balance sheet improvements

and boosted cash generation capabilities

One of the objectives of implementing the management reforms described above is to strengthen the financial base. In fiscal 2023 and fiscal 2024, we steadily improved our balance sheet and enhanced our cash generation capabilities through the reduction of inventories and trade receivables. In addition, we significantly reduced interest-bearing debt by utilizing the proceeds from the transfer of businesses positioned as non-focused or direction-changing businesses. This also reduced interest expense in the face of rising interest rates.

In fiscal 2025, we plan to resume dividend payments by continuing to reduce interestbearing debt and further improving earnings while allocating funds for growth investments such as equipment.

Reinforcing the business management system to ensure stable earnings

and future business growth

Our reflection on major impairment losses recorded in precision medicine and other businesses has informed our efforts to reinforce our business management system to ensure stable earnings and create a framework to support future business growth. As part of this framework, we have revised our internal recognition of and approach to recording impairment losses, and in addition to periodic impairment testing in accordance with international accounting standards, we have established an internal voluntary impairment monitoring system that enables us to identify early signs of impairment.

We also reviewed our new business development process. We have adopted a stagegate system for new business development, and we will more strictly apply conditions for moving to the next stage. Going forward, we will also focus on highly certain and promising themes by verifying customer value and technical feasibility more thoroughly than before.

We plan to incorporate this into our future medium-term plans only after such validation gives us confidence in these themes.

Focus Policies for the Final Year of the Medium-term Business Plan (Fiscal 2025)

Achieving a V-shaped profit recovery and establishing a foundation for future growth

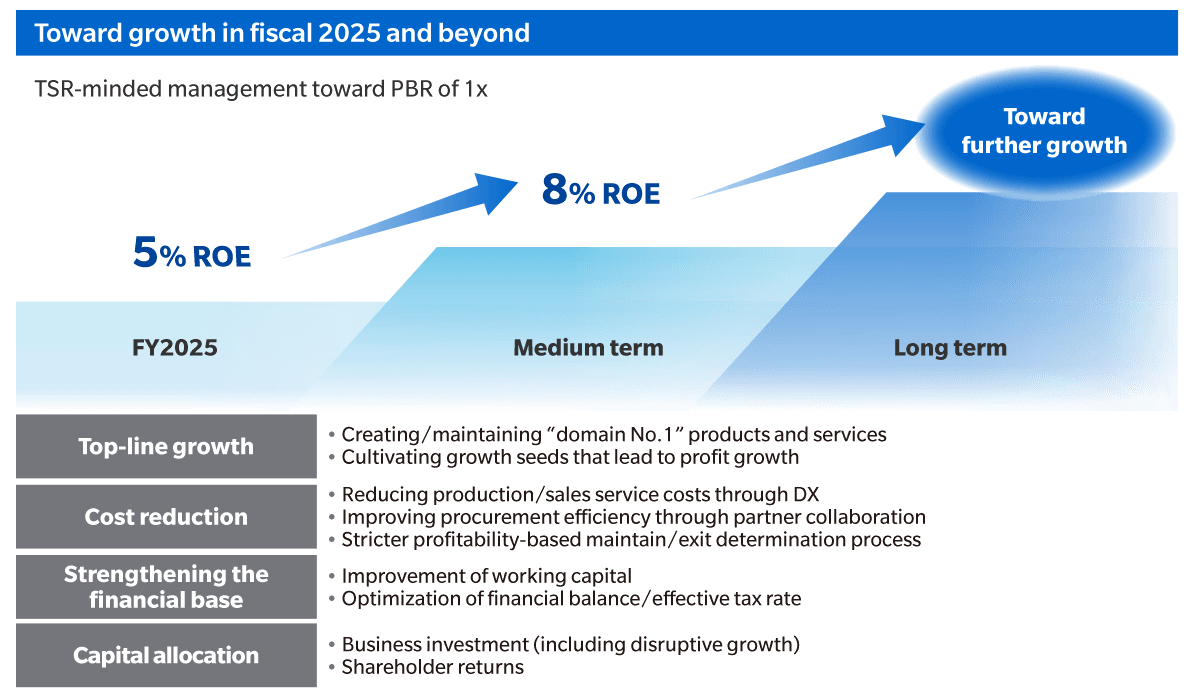

Fiscal 2025, the final year of our Medium-term Business Plan, has been positioned as “Turn Around 2025,” where we have set the following two focus policies. The first policy is to achieve a V-shaped recovery in operating profit and profit attributable to owners of the Company, while achieving ROE of 5% or more and resuming dividend payments to shareholders. Although ROE of 5% does not fully meet capital market expectations, we believe it is a necessary first step to increase ROE to 8% or more. To this end, we will firmly increase our current performance through the effects of management reforms and profitable growth in our businesses. The second policy is to ensure the materialization of new businesses that will be “growth seeds” into fiscal 2026 and beyond.

For fiscal 2025, our forecast is for revenue to decrease year on year due to business transfers and the appreciation of the yen, but in real terms, we anticipate a 2% revenue increase. Business contribution profit is expected to turn profitable at ¥52.5 billion and business contribution profit ratio at 5%, thanks to the effects of business growth and management reforms. We also forecast operating profit of ¥48.0 billion and profit attributable to owners of the Company of ¥24.0 billion. This will enable us to achieve ROE of 5%, and we will aim to pay an annual dividend of ¥10 per share.

As for the external environment in fiscal 2025, we expect to be affected by the U.S. reciprocal tariffs on a global basis, and at the time of the first quarter results, we reflected this reciprocal tariff impact in our forecast for the full fiscal year. We will absorb this by reviewing our already implemented go-to-market strategies such as price actions, channel and regional strategies, and by making additional cost reductions. Since the impact of reciprocal tariffs will not be limited to fiscal 2025, we are accelerating studies and execution of specific measures such as the continued shift of production to countries with low tariff rates and streamlining of our operating structure by shifting from a business focus to a region focus.

Performance Outlook

| FY2023 (Including discontinued businesses) |

FY2023 (Excluding discontinued businesses) |

FY2024 | FY2025 (Forecast) |

|

|---|---|---|---|---|

| Revenue | 1159.9 | 1107.7 | 1127.8 | 1050.0 |

| Business contribution profit | 26.0 | 33.3 | 31.9 | 52.5 |

| Operating profit | 26.0 | 27.5 | -64.0 | 48.0 |

| Profit attributable to owners of the Company | 4.5 | 4.5 | -47.4 | 24.0 |

| Dividends (yen/share) | 5 | 5 | 0 | 10 |

| ROE (%) | 0.9 | 0.9 | -9.5 | 5 |

Toward more improved earnings in existing businesses

In addition to the effects of business selection and concentration and global structural reforms implemented in fiscal 2024, we will work to further improve profitability in each of our businesses in order to strengthen our profit foundation in fiscal 2025 and beyond.

The office unit of the Digital Workplace Business is performing solidly, and along with the creation of benefits from global structural reforms, we are working to enhance profitability by improving production, sales, and service efficiency through cost reductions and DX promotion.

In the production print unit of the Professional Print Business, we will maintain the largest share of Heavy Production Print (HPP) machines by launching new products, and by recapturing the No. 1 share of Mid Production Print (MPP) machines, we will continue to expand non-hardware revenue mainly from mid- to large-sized commercial printing customers.

On the other hand, in fiscal 2024, we recognize that earnings growth each of the performance materials, sensing, healthcare, and industrial printing business units has lagged behind, and we recognize this as a management issue.

In the performance materials unit, we are focusing on expanding sales of SANUQI, anew resin film for large-size TVs, and preparing for the launch of sales of SAZMA, a new material film. In fiscal 2024, demand changed at a pace exceeding our assumptions,causing our supply to fall short. However, we have already taken measures to expand production capacity for SANUQI. Furthermore, by introducing high transparency TAC (cellulose triacetate) film models tailored to market needs, we will accurately capture demand in fiscal 2025 and aim for a comeback.

In light source color measurement within the sensing unit, one of the factors that contributed to deteriorated earnings in fiscal 2024 was that the introduction of inspection instruments used in production lines did not proceed as planned due to postponement of capital investment by major customers. Going forward, the challenge will be how to elevate our foundation while keeping a close eye on market conditions for capital investment. In addition to establishing a system that can meet the demands of major customers, we will continue to shift to a business structure for growth, including automotive visual inspection and measurement equipment based on hyperspectral imaging, which images a wide range of wavelengths by dividing into numerous pieces.

In the healthcare unit, growth stalled in fiscal 2024 due to lower demand for analog film in China. Meanwhile, we continue to focus on our Dynamic Digital Radiography system, the only one of its kind in the world. In Japan, although the introduction of this system has begun, mainly at large and national hospitals, the pace of diffusion has not yet reached the expected level. Currently, we are in the process of accumulating a number of specific cases demonstrating how the introduction of our Dynamic Digital Radiography system will add value to clinical practice. We also aim to achieve solid results in the next Medium-term Business Plan by strengthening cooperation with external medical and research institutions and through the dissemination of information by key opinion leaders (KOLs).

In the industrial print unit, we will maintain the top share for digital label presses and accelerate digitalization in the market by further expanding the market and launching new B2-size UV inkjet presses (AccurioJet 30000). The number of installed digital inkjet presses (AccurioJet KM-1e) capable of B2-size large-format printing has grown over time, and the ink and other consumables business is also growing steadily. In embellishment printing, which adds value to printed materials, materials printed on our digital presses are subjected to secondary processing on France-based MGI’s embellishment presses to create printed materials with an unprecedented sense of luxury and three-dimensionality. We are not yet able to offer our customers packages of embellished printing solutions that other companies do not offer, and we expect further growth in this area. In addition, as a differentiated solution, we are also developing the EX Kansei solution, a design analysis service that quantitatively visualizes human senses by combining our unique strengths in image processing and color analysis technologies with Kansei (sense) brain engineering. Going forward, we intend to achieve sustainable growth by continuously enhancing the value of our unique total solutions.

Cultivating growth seeds through organic spillover, not drastic separation,

from existing businesses

As described so far, we are focusing on strengthening the profitability of existing businesses and recovering their performance levels, while at the same time creating new businesses that will drive medium- to long-term growth with an eye to the future. Specifically, we are working to turn themes with promising outlooks into viable businesses by using AI to enhance technologies derived from existing businesses, such as precision processing, resin molding, film forming, and spectrophotometry. We will leverage the technology and expertise we have cultivated in our existing businesses and focus on areas with organic spillover from our existing businesses to enhance the chance of success in generating new businesses. This will harness our experience from past failures, when M&A in areas drastically separated and disconnected from our existing businesses did not yield the results we had hoped for.

For example, we have already established a strong relationship of trust with our customers for optical components for semiconductor manufacturing equipment in the Industry Business, and we will strengthen our production system by increasing our facilities to meet growing demand in the future. We will also challenge ourselves in other areas such as recycled plastic material production, barrier films for perovskite solar cells, and process monitoring for biomanufacturing. These were selected from among several technological themes based on an evaluation of market growth potential, the possibility of establishing a competitive advantage, and the probability of generating revenue as a business. Based on our updated new business development process, we will diligently conduct PoCs from technical and business aspects, fully verify potential customer value, reflect this in our medium- to long-term sales and profit plans, and make appropriate investments to nurture businesses into those that will contribute to increased profits.

Many of these seeds of growth are not top-down, but rather based on our material issues oriented to 2030, and they have been created from the bottom up from the business frontlines. It is very encouraging to see so many of these seeds of growth emerging from our business sites in this way. A new business will not succeed without the passion of employees in front lines of the field, who want to make sure that it blossoms. We believe that it is our role in management team to take into account the wishes of those in the field, evaluate and select businesses in a diligent process, and encourage initiatives that should move forward.

Toward medium- to long-term growth in fiscal 2026 and beyond

Aiming for 8% ROE by generating profits through top-line growth

To reach the next step of aiming for ROE of 8% or even higher after ensuring achievement of 5% ROE in fiscal 2025 sustainable growth in profits from our businesses is the first essential element. Therefore, in existing businesses, it is important to anticipate customer demand and adapt appropriately. Though we have been pursuing a “genre-top strategy” that focuses on markets with growth potential and aims to capture market share, going forward, we will evolve to a “domain No. 1” strategy. Here, we will focus on maintaining the No. 1 position for products and services that already have the No. 1 market share and capturing the No. 1 position for those that are No. 2 or lower.

On the other hand, in terms of business models, we are already promoting recurring businesses that can ensure continuous profitability in the Business Technologies Business and part of the Imaging Solutions Business, an initiative that has received high praise from shareholders and investors. Going forward, we intend to expand this recurring business model broadly to other business areas, and through the formulation and implementation of each business strategy, we hope to improve profitability.

In addition, by taking the aforementioned themes that will serve as growth seeds and turning them into viable businesses, we will achieve early profit contributions.

We will also continue to focus on generating profits through cost reductions. In fiscal 2024, we established Global Procurement Partners Corporation as a joint venture with FUJIFILM Business Innovation Corporation in the Business Technologies area, a conduit for new initiatives in the procurement function for raw materials and components. Through this joint venture, the two companies will utilize our extensive supplier networks to strengthen respective business foundations by establishing a stable supply system for products and reducing costs.

We will also focus on improving productivity through the fusion of data utilization and AI technology, continuously monitoring the progress of per capita revenue and business contribution profit.

Furthermore, we must pivot our management to pursue capital efficiency in each business on a daily basis, with a stronger awareness of the cost of shareholders’ equity and efficiency of invested capital.

Medium- to long-term ROE improvement measures

Helping to realize a sustainable society through our business activities

At Konica Minolta, our aim is to contribute to the realization of a sustainable society by creating value through our business activities to solve the issues faced by our customers and society, while at the same time achieving sustainable growth ourselves. The growth strategies I previously mentioned also constitute practice of this kind of sustainability management. For example, recycled plastic materials, barrier films for perovskite solar cells, and process monitoring for biomanufacturing, which were introduced above as growth seeds, are all themes that contribute to addressing climate change and using limited resources effectively, both of which are our material issues.

In addition, with respect to the goal of achieving Carbon Minus* in fiscal 2025, fiscal 2024 performance was on track as expected, and we intend to ensure this goal will be achieved.

Furthermore, we have pioneered the implementation of human rights due diligence and other measures to address the growing social concern about human rights. We intend to continue strengthening our commitment to human rights, not only within the Group but also throughout the supply chain.

* Carbon Minus: A state in which CO2 emissions in the lifecycle of our products (Scope 1, 2, and 3 emissions) are reduced and at the same time the amount of contribution to CO2 reduction (Scope 4) is generated that exceeds the amount of Scope 1, 2, and 3 emissions through collaboration with stakeholders such as customers and suppliers. Our goal is to build more competitive businesses by generating and enhancing the impact of our reduction contribution.

Shareholder value-conscious management aiming for a PBR of 1x or more

We sincerely recognize that our current stock price level is the result of the capital market’s severe evaluation of our performance and management.Going forward, we intend to achieve a PBR of 1x or more by steadily promoting profitable growth in our businesses, nurturing growth seeds in the next Medium-term Business Plan, and reflecting the value of research and development in shareholder value.

Additionally, Konica Minolta has paid a portion of officer compensation in the form of stock bonus so far. In order to further practice management taking the perspective of our shareholders, we will introduce total shareholder return (TSR) as an evaluation indicator for the stock compensation plan for Executive Officers starting in fiscal 2026. By incentivizing contributions to greater shareholder value, we will shift management to be more conscious of shareholder value than before.

We are breaking from past traditions, ready to move on to the next stage. Through internal financial results briefings such as CEO LIVE! events, I have told employees that we can no longer use the past to make excuses. Going forward, we must not be conservative in how we envision our future growth, but instead compete with a mindset to pioneer the next stage of growth. I myself believe that my own role is to truly transform the Company by bringing out that awareness and leading it to fruition. On behalf of Konica Minolta, I sincerely appreciate your continued support of our endeavors.

September 2025